Selecting a CEO for a Leveraged

Middle-Market Organization

By Robert J. Meehan

I have been a CEO and Interim CEO of Leveraged Middle-Market Organizations (“LMMO”) and involved in many CEO searches. My recommendations are based on these experiences.

CEO turnover is a major challenge facing boards, and it’s both disruptive and expensive. Selecting a CEO, then, is a most important responsibility for a board of directors—since the new CEO will be a major determinant of the organization’s success or failure:

- “CEO departures are on pace to hit the highest level on record this year,” according to executive outplacement firm: Challenger, Gray & Christmas (2019).

- PricewaterhouseCoopers published a 2019 report that found “successors to long-serving CEO’s are likely to have shorter tenures, worse performances and more are forced out of office than the CEO’s they replaced.”

- Forbes.com reported that “some 40% of new CEO’s are fired or ‘retired’ within their first 18-months.”

Much has been written about the CEO search process for Fortune 500 sized organizations. Less information is available, however, for an LMMO, whose CEO selection process may be even more difficult because of the additional constraints: debt levels, limited cash, fewer resources and a less-predictable revenue stream. It may also encounter a more limited candidate pool—as some qualified CEO candidates don’t want to work for an LMMO.

Business environments continue to be more ambiguous, complex and disruptive as consumers and customers have better purchasing information available to them. CEO’s must either be able to anticipate or adapt quickly to sudden

changing competitive conditions. Different strategic environments require different CEO skill-sets and experience bases.

The CEO candidate must have strategic as well as operational skills. Many of these candidates may excel at creating efficiencies but might lack strategic thinking. No amount of counseling or coaching can make the wrong CEO suitable.

“CEO departures are on pace to hit the highest level on record this year,” according to executive outplacement firm: Challenger, Gray & Christmas.”

Based on over twenty-five years of experience, I have found the common threads for an unsuccessful LMMO CEO search are:

- Focusing on CEO’s past experiences—when such experiences may not be relevant to this organization’s current situation;

- Hiring CEO’s who were efficiency experts but couldn’t pivot to developing and implementing a strategy in order to organically grow the revenue base;

- Succumbing to search fatigue and “settling” on a candidate.

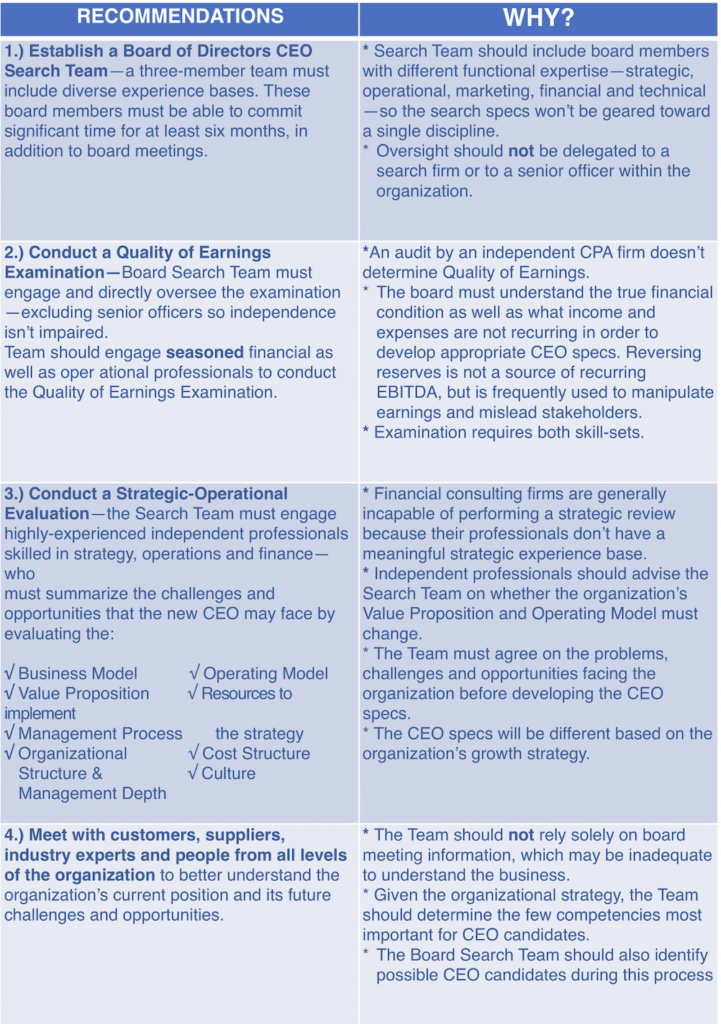

Required Foundation for the CEO Search

Some board members will read these recommendations and say, wow, that’s a lot of work. Absolutely it is. However, hiring the wrong CEO could result in a viability crisis. The Board Search Team will gain the necessary CEO search foundation if it implements all four of the above recommendations.

Required Foundation for the CEO Search (continued)

All stakeholders—equity, debt, customers, suppliers, employees—must play important roles in the CEO Search Process. For instance, a highly-leveraged organization—pushing its debt limits—may have to discuss how to fund the search process with its lenders so its limited availability won’t be interrupted.

Example: Quality of Earnings

The independent auditors concluded their examination of the financial statements without identifying any significant write-offs. Our Strategic-Operational Evaluation began at this time. As a bi-product of our evaluation, we identified significant write-offs related to the current year as well as the two previous years. Such write-offs immediately

triggered debt covenant defaults and significantly reduced projected cash flows. Most importantly it forced the company to begin fixing its serious problems.

After “recording” the write-offs in the proper years, we found that the company had been in violation of its debt covenants for the last two years. If they had known previously, lenders would have forced the company to fix the problems two years earlier. The company wasted two years it had to begin fixing the serious problems. Getting a Quality of Earnings Examination is a must.

Example: Research Study at Over 850 American Companies

I highly recommend reading “Searching for a Corporate Savior: The Irrational Quest for Charismatic CEO’s” written by Rakesh Khurana, an Assistant Professor of Organizational Behavior at the Harvard Business School. Khurana’s findings are based on a study of the hiring and firing of CEO’s at over 850 of America’s largest companies and on extensive interviews with CEO’s, corporate board members and consultants at executive search firms.

Dr. Khurana found that “corporations have increasingly sought CEO’s who are above all else charismatic…but whose experience and abilities are not necessarily right for companies specific needs.”

Again, to determine the specific needs of the organization, the Board Search Team must:

- Engage a Strategic-Operational Evaluation by highly-experienced independent professionals, and

- Meet with customers, suppliers, industry experts and people from all levels of the organization to better understand the needs, opportunities and challenges facing the organization.